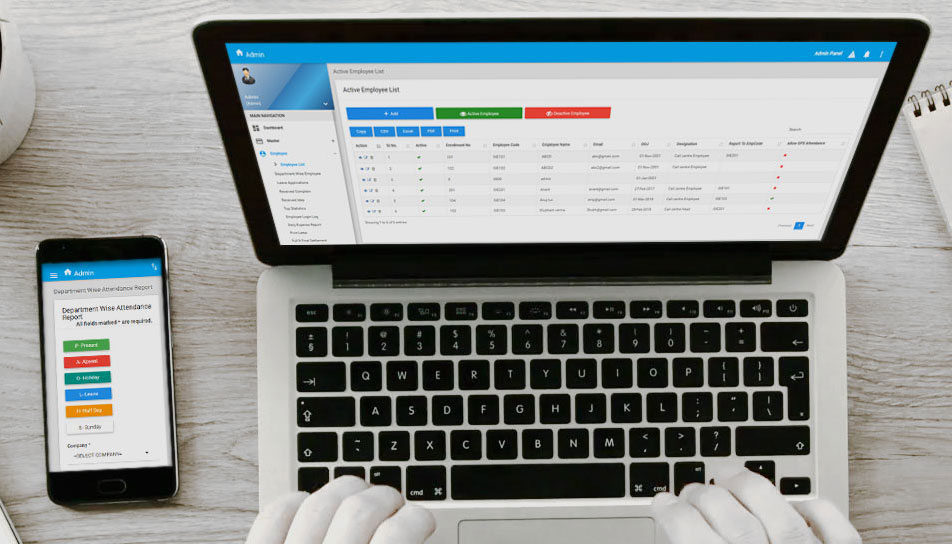

Outsourcing payroll software solution

Payroll software is a system that automates and streamlines the process of paying a company’s employees. It may sound straightforward, but the payroll process includes a lot of tasks such as calculating deductions and withholdings, producing pay slips and tax forms (and other reports), processing or depositing payment directly to employee’s bank account, voiding payments if need be, and even printing checks. Payroll software simplifies and automates the aforementioned tasks to shorten cycle times and reduce manual errors.

Some Main Features of HR & payroll Software:

- Employees Detail Profile Module.

- Employee Performance Evaluation Module

- Employee Training Module.

- Employee Termination and Pension Module.

- Employee Recruitment Process Module.

- Manage Employee Information Efficiently.

- Employee Career detail, Personal Detail, Documents, Academic Information etc.

- Define the Banking info, deductions, leave, tax, Provident fund etc.

- Create individual or group Salary Structure and Allowances .

- Generate Pay-Slip at the convenience of a mouse click.

- Generate all the Reports related to Branch, Department, employee, attendance/leave, and payroll, Bonus etc.